Have you ever wondered how urgent care clinics manage to update and improve their buildings to better serve patients in 2025 and beyond? Renovating an urgent care center isn’t just about fixing walls – it often means adding new medical equipment, making the space more comfortable and safe, and following strict healthcare rules. But one of the biggest challenges is figuring out how to pay for these costly renovations of urgent care.

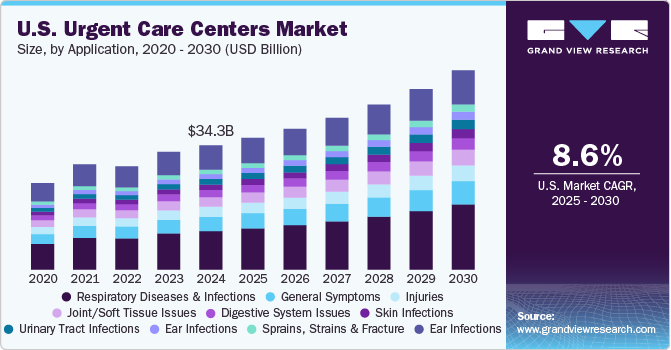

According to a 2024 report by Grand View Research, the U.S. urgent care centers market was valued at $34.34 billion and is projected to grow at an annual rate of 8.6%, reaching $55.07 billion by 2030.

This growth is driven by increasing patient demand, the need for modern facilities, and the expansion of services.

At Lux Construction Group, we specialize in urgent care construction and renovation services in Los Angeles, helping clinics transform their spaces with expert craftsmanship and attention to healthcare standards.

Understanding your financing options is essential to ensure your renovation project runs smoothly and stays within budget.

In this blog, we’ll walk you through the main financing choices available for urgent care renovations and share best practices for managing funds wisely. Whether updating patient areas or adding new diagnostic tools, knowing how to finance your project will give your clinic the confidence to grow and provide better care.

Contents

- Why Invest in Urgent Care Renovation, & What Are the Key Benefits?

- Enhancing Patient Experience & Safety

- Improving Workflow & Staff Efficiency

- Accommodating New Services & Technology

- Boosting Brand Image & Competitiveness

- Increasing Property Value & ROI Potential

- Regulatory Compliance & Risk Reduction

- Energy Efficiency & Cost Savings

- Enhanced Accessibility

- Top Financing Options for Urgent Care Renovations

- Best Practices for Securing & Managing Urgent Care Renovation Financing

- Detailed Planning & Budgeting

- Prepare a Strong Loan Application

- Choose the Right Lender & Loan Product

- Understand Loan Terms, Covenants & Collateral

- Manage Cash Flow During Renovations

- Address Legal & Compliance Requirements

- Key Considerations Before Committing to Financing Urgent Care

- Total Cost of Borrowing

- Impact on Clinic Cash Flow and Profitability

- Alignment with Long-Term Business Goals

- Personal Guarantees and Collateral Risks

- Final Words

- FAQs About Urgent Care Renovation Financing

- 1. What are common challenges urgent care centers face during renovation projects?

- 2. How can urgent care centers minimize disruption to patients during renovations?

- 3. What permits are required for urgent care renovations?

- 4. How does telemedicine integration affect urgent care renovation plans?

- 5. Are there tax incentives available for urgent care facility renovations?

- 6. What role does technology play in urgent care facility upgrades?

- 7. How long does an urgent care renovation typically take?

- 8. Can urgent care renovations improve patient retention?

- 9. What financing options are available specifically for energy-efficient urgent care renovations?

- 10. How can urgent care clinics assess ROI on renovation investments?

Why Invest in Urgent Care Renovation, & What Are the Key Benefits?

Investing in urgent care renovation offers several important benefits that go beyond just improving the look of your facility.

Here, we discuss the key benefits of urgent care renovations:

Enhancing Patient Experience & Safety

A well-designed, modern urgent care center creates a welcoming environment that puts patients at ease. Renovations often include updated waiting areas, private exam rooms, and improved signage, all of which help patients feel more comfortable and reduce stress. Enhanced safety features, like better infection control measures and compliance with healthcare regulations, also protect patients and staff.

Improving Workflow & Staff Efficiency

Moving further, renovating your urgent care facility allows you to optimize layouts and allocate space more effectively. Dedicated areas for specific services, streamlined patient flow, and improved staff workspaces can increase efficiency and reduce wait times, leading to better patient care and higher staff satisfaction.

Accommodating New Services & Technology

Healthcare is rapidly evolving, with urgent care centers adding new diagnostic tools, telemedicine options, and treatment capabilities. Renovations help you create space for these advancements, enabling your clinic to offer a wider range of services and stay competitive.

Boosting Brand Image & Competitiveness

A modern, well-maintained facility signals quality and professionalism to patients and referral sources. Renovations can help your urgent care stand out in a crowded market, attract new patients, and reinforce your commitment to excellent care.

Increasing Property Value & ROI Potential

Beyond immediate benefits, renovations can increase the value of your property as a long-term asset. Updated facilities are more attractive to potential buyers or investors and can contribute to higher revenue through increased patient volume and service offerings. It also increase the revenue of your urgent care clinic by enhancing patient experience, improving efficiency, and supporting expanded services.

Regulatory Compliance & Risk Reduction

Furthermore, renovations ensure your urgent care center stays up-to-date with healthcare regulations, reducing legal risks and costly penalties. Compliance builds patient trust and facilitates smoother regulatory inspections.

Energy Efficiency & Cost Savings

Modern renovations often include energy-efficient lighting, HVAC, and water systems, reducing utility costs and improving your clinic’s environmental footprint.

Enhanced Accessibility

Upgrading entrances, restrooms, and treatment areas to meet ADA (Americans with Disabilities Act) standards improves access for all patients, expanding your clinic’s reach and meeting legal requirements.

Understanding the many benefits of renovating your urgent care facility is just the first step – the next vital part is exploring the various financing options available to help bring these improvements to life without straining your clinic’s finances.

Top Financing Options for Urgent Care Renovations

Finding the right way to finance your urgent care renovation can feel overwhelming, but understanding the available options helps you make informed decisions that fit your clinic’s needs and budget.

Here are some of the most common and practical financing choices for urgent care center renovations:

| Financing Option | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| SBA Loans (7(a), 504 Programs) | Government-backed loans with favorable terms, longer repayment periods, and lower down payments. | Lower down payments, longer terms, lower interest rates. | Lengthy application process, strict eligibility requirements. | Large renovation projects, real estate purchase + renovation. |

| Traditional Bank / Term Loans | Direct loans from banks or credit unions with competitive interest rates based on credit history. | Competitive rates, established lender relationships. | Stricter credit requirements, significant collateral often needed. | Clinics with strong credit and financial standing. |

| Healthcare-Specific Lenders | Loans from lenders specializing in healthcare industry financing. | Flexible terms, tailored repayment plans, faster approvals. | Potentially higher interest rates than traditional banks. | Medical practices needing customized financing solutions. |

| Equipment Financing & Leasing | Funding or leasing specifically for medical equipment as part of renovations. | Preserves cash flow, easier qualification, equipment as collateral. | Only covers equipment costs, leasing means no ownership unless purchased later. | Upgrading or acquiring new medical equipment. |

| Business Lines of Credit | Flexible credit allowing draws up to a limit, with interest paid only on amounts used. | Flexible borrowing, good for phased renovations, covers unexpected costs. | Variable interest rates, may not suit large-scale projects. | Managing cash flow during renovations and covering unforeseen expenses. |

| Private Equity / Investor Funding | Funding from private investors or equity partners in exchange for ownership shares or profits. | Large capital injections, strategic partnerships. | Loss of some ownership/control, profit sharing required. | Large expansions or turnarounds needing significant capital and expertise. |

Now that you understand the different financing options available for urgent care renovations, it’s equally important to follow proven best practices to secure funding successfully and manage your renovation budget effectively.

Best Practices for Securing & Managing Urgent Care Renovation Financing

Securing financing for your urgent care renovation is just the beginning. How you prepare, apply for, and manage your funds can make a big difference in ensuring your project stays on track and within budget.

Here are some best practices to guide you through the process:

Detailed Planning & Budgeting

- Start by clearly defining the scope of your renovation.

- Obtain detailed quotes from multiple contractors to get an accurate estimate.

- Esure to include a contingency fund—typically 10-20% of your budget—to cover unexpected expenses.

- This upfront work helps avoid surprises and builds confidence with lenders.

Prepare a Strong Loan Application

- A compelling loan application increases your chances of approval.

- Develop a comprehensive business plan that outlines the renovation’s expected return on investment (ROI).

- Gather financial documents like profit and loss statements, balance sheets, and cash flow reports from the past 2-3 years.

- Including personal financial statements of clinic owners can also strengthen your application.

Choose the Right Lender & Loan Product

- Don’t settle for the first loan offer.

- Compare interest rates, repayment terms, fees, and lender experience with healthcare financing.

- A lender familiar with medical facility projects may offer more tailored solutions and flexible terms.

Understand Loan Terms, Covenants & Collateral

- Carefully review all loan documents.

- Be aware of covenants, restrictions, and collateral requirements, such as debt-to-income ratios or reporting obligations.

- Understanding these details helps avoid costly surprises later.

Manage Cash Flow During Renovations

- Maintain open communication with contractors and lenders.

- Establish clear project timelines and milestones.

- Track expenses regularly against your budget to prevent overspending.

- Consider temporary financing or bridge loans if cash flow tightens during construction.

Address Legal & Compliance Requirements

- Make sure your renovation plans include costs and time for obtaining permits, zoning approvals, and inspections.

- Compliance with healthcare facility regulations is mandatory and helps avoid delays or fines.

With these best practices in place to help secure and manage your renovation financing, it’s important to also weigh key considerations that could impact your clinic’s financial health and long-term goals before making a final commitment.

Key Considerations Before Committing to Financing Urgent Care

Before finalizing any financing agreement for your urgent care renovation, carefully evaluate these critical factors to ensure your clinic’s financial stability and future success:

-

Total Cost of Borrowing

Understand all costs involved, including interest rates, fees, and any hidden charges. Even a small difference in rates or fees can add up significantly over the life of a loan.

-

Impact on Clinic Cash Flow and Profitability

Consider how loan repayments will affect your monthly cash flow. Ensure that your clinic can comfortably meet these payments without compromising day-to-day operations or emergency reserves.

-

Alignment with Long-Term Business Goals

Ensure the financing aligns with your clinic’s strategic goals. For example, a short-term loan may not be ideal for a large-scale renovation with a long ROI timeline.

-

Personal Guarantees and Collateral Risks

Be aware of any personal guarantees required by lenders and the assets you may be putting up as collateral. Understand the risks involved in case of default.

Careful evaluation of these factors helps prevent financial strain and supports sustainable growth. Taking the time to assess risks ensures your urgent care renovation is both affordable and strategically sound.

Final Words

Renovating your urgent care facility is a smart investment that enhances patient experience, boosts staff efficiency, and supports new services. Choosing the right financing option—whether SBA loans, bank loans, equipment leasing, or lines of credit is key to making your renovation affordable and manageable. Moreover, pairing financing with solid planning and expert guidance ensures your project stays on budget and supports long-term growth.

Ready to upgrade your urgent care center with confidence? Contact Lux Construction Group, your trusted partner for expert urgent care construction and remodeling services in Los Angeles.

Let’s build the future of your clinic together.

FAQs About Urgent Care Renovation Financing

1. What are common challenges urgent care centers face during renovation projects?

Urgent care centers often face challenges such as maintaining patient flow during construction, managing unexpected costs, complying with healthcare regulations, and coordinating contractors. Proper planning and phased renovations can mitigate disruptions and keep the project on schedule.

2. How can urgent care centers minimize disruption to patients during renovations?

Scheduling renovations in phases, using temporary facilities, and clear patient communication help minimize disruptions. Ensuring critical services remain operational reduces patient inconvenience and protects revenue during construction.

3. What permits are required for urgent care renovations?

Urgent care renovations typically require building permits, health department approvals, and zoning clearances. These vary by location, so consulting local authorities early ensures compliance and prevents project delays.

4. How does telemedicine integration affect urgent care renovation plans?

Renovations should allocate space and infrastructure for telemedicine equipment and private consultation areas. Incorporating telehealth supports expanded services and meets growing patient demand.

5. Are there tax incentives available for urgent care facility renovations?

Some states offer tax credits or deductions for healthcare facility improvements, energy-efficient upgrades, or ADA compliance. Consult a tax advisor to identify applicable incentives and maximize savings.

6. What role does technology play in urgent care facility upgrades?

Technology upgrades like electronic health records (EHR), digital check-ins, and advanced diagnostic tools improve patient care efficiency and data management, influencing space design and electrical requirements in renovations.

7. How long does an urgent care renovation typically take?

Renovation timelines vary based on project scope but typically range from 3 to 12 months. Factors include permitting, construction complexity, and phased scheduling to maintain clinic operations.

8. Can urgent care renovations improve patient retention?

Yes, modernized facilities with improved comfort, technology, and workflow enhance patient satisfaction, leading to higher retention rates and positive word-of-mouth referrals.

9. What financing options are available specifically for energy-efficient urgent care renovations?

Energy-efficient upgrades may qualify for green loans, government grants, or utility rebates. These programs often offer favorable terms to encourage sustainable healthcare facility improvements.

10. How can urgent care clinics assess ROI on renovation investments?

Clinics should evaluate increased patient volume, operational efficiency, energy savings, and enhanced service offerings to calculate ROI. Tracking financial performance before and after renovations provides insights into investment impact.